Power for AI Leadership: America’s Manhattan Project for Ai Energy

Retire coal, cap gas, standardize nuclear, and wire the continent—so America owns the AI century.

Current Situation: 2025

China leads U.S. in electricity production

China generated ~9,300 TWh in 2023 (≈2.2× the U.S.).

Generation was ~59–61% coal, ~3% gas, with fast-rising wind/solar and nuclear build outs. U.S. Energy Information Administration+1 Coal is the backbone (polluting), but China’s manufacturing edge in cleantech equipment remains a structural advantage that drives their installation of solar and wind and storage projects. Financial Times

China’s lead is not based on population. Per-capita, 6.6 MWh/person (China) vs 12.5 MWh/person (U.S.).

Some say China produces twice the electricity it needs. When you add their investment in nuclear, their strategy may be to leap frog to climate leadership utilizing dirty coal for now.

United States generated~4,178 TWh in 2023utility-scale,+~74 TWh small-scale solar (Residential, Commercial, Small Industrial - Behind the Meter). Mix ≈ 60% fossil, 19% nuclear, ~21% renewables. U.S. Energy Information Administration+1 Canada → U.S.: Hydro imports swing with hydrology. 2024 imports fell to ~10 TWh (drought). Energy Analysis+2Federal Energy Regulatory Commission+2Gas delivery pipeline constraints - litigious path is emblematic. Reuters+1 NRC process constraints even with federal pressure to accelerate. Nuclear Regulatory Commission+1 Interconnection queues in poor shape Projects stuck for years; FERC Order 2023/2023-A reforms process but utilities/ISOs are mid-implementation. Transmission: Big gaps.

What will it take for the U.S. to “catch up”?

Return Canada net energy imports to historic levels - Target:50 TWh per year.

Natural gas (fast-cycle + combined-cycle) as near-term firm; prioritize siting near load pockets and co-site with DC campuses; plan for H₂-readiness. Pipeline expansions on critical corridors (e.g., Appalachia→Mid-Atlantic). Reuters

Nuclear:

Short-term: life-extensions and restarts (e.g., Palisades).

Mid-term: 1–3 standardized large PWR orders; SMR/advanced FOAK→NOAK glide path using accelerated NRC targets. Reuters

CCS/“clean coal”: Petra Nova is back online and shows technical viability. Surgical use near coal fleets - ties to CO₂ pipeline/storage buildouts; leverage Petra Nova learnings. Clearpath Action

Wind/Solar + Storage: (transmission + interconnection fixed). Grow despite reduced incentives. Add long-duration storage pilots for evening peaks. The Department of Energy's Energy.gov

2026–2030 – 4 Priorities:

Push net Canadian energy imports as far as physics + politics allow. In 2025, we are on track for 18 TWh net from Canada. The highest net from Canada was 47 TWh in 2020. Get back to historic levels.

Clear interconnection backlogs under FERC 2023/2023-A;. Federal Energy Regulatory Commission

Commission fast-cycle gas near DC (Data Center) clusters; align with on-site generation where utilities can’t meet timelines. Business Insider

Nuclear: finalize 2 standardized designs; execute 4 life-extension projects. Reuters

Proof of Concept today (in 2025)

New nuclear is actually online in the U.S. again. Vogtle 3 entered service Jul 31, 2023 and Vogtle 4 on Apr 29, 2024—demonstrating we can still build large reactors to completion. Southern Company

Next Steps: Standardized designs, modular EPC (Engineering, Procurement, Construction) supply trains,” performance bonds, and a federal engineer bench. (Note: France added dozens of reactors within ~15 years in the 70s–80s with this plan) World Nuclear Association+1

A closed reactor is restarting. NRC has approved key steps for Palisades to return to service, with DOE loans disbursed and a late-2025 restart target—first U.S. restart ever. Reuters+1

Interregional delivery is real, near-term. The Champlain Hudson Power Express (1.25 GW) HVDC line to NYC is under construction and scheduled for spring 2026 COD—evidence that big transfer “arteries” can be built on a fixed timeline. TDI CHPExpress+1

Equipment bottlenecks (transformers/converters): Onshore manufacturing credits + Defense Production Act prioritization; dual-sourcing for HVDC valves. (Global HVDC fleets already exceed 175 projects / ~320 GW capacity.) Market Growth Reports

Grid controls for inverter-heavy systems are standardized and piloted. IEEE 2800-2022 codifies performance requirements. Grid-forming pilots are underway across multiple systems. IEEE Standards Association+1

Long-duration storage is moving from paper to projects (e.g., 100-hour iron-air demos paired with large solar). Fresh Energy+1

Stretching for the Future (Ai and energy transition)

U.S. data center electricity demand (stretch goal: 500 TWh)

DOE’s latest puts 2023 U.S. DC = 176 TWh (~4.4%), rising to ~325–580 TWh by 2028 (6.7–12%). McKinsey’s >14% by 2030). Business Insider Target 500 TWh ≈ 12%. To actually hit 15%, you’re talking ~630 TWh. The Department of Energy's Energy.gov+1

Stretch target for electricity production for Data Centers≈ 1,000 TWh in 2030

Stretch target for more Manufacturing: +25% jump in U.S. industrial/manufacturing electricity

~260 TWh). Reuters

Everything else (EVs + buildings electrification + “normal” load):

+~100 TWh by 2030 (conservative add on top of today’s 4.18 PW base). Reuters

This puts the U.S. ~+1.1 to +1.3 PWh above 2023—mostly driven by AI (¾ of the Change),

Milestones:

Grid scale: Planning for ~+1.2 PWh more supply over 10 years (2026-20350—

about 30% growth vs. 2023.

AI dominance condition: Holding ~1.0 PWh for DCs in 2030

keeps the U.S. ahead of China’s ~0.4–0.6 PWh

Manufacturing re-industrialization: +25% industrial kWh (to ~1.3 PWh) restores a meaningful chunk of heavy-industry activity onshore. Reuters/EIA show industrial sales around ~1.04 PWh in 2024, so the lift is ~+260 TWh. Reuters

Mission framing:

National security priority:

Reliable, abundant, low-cost power is strategic infrastructure—on par with chips and LNG. The goal is building capacity near loads (Data Centers (DC), and Manufacturing)

Key Steps:

Pass the Energy Security Fast-Track Act:

Shot-clocks

One-stop lanes

Reliability Corridors

Interconnection SLAs

Capacity build near loads

Establish the Federal National Power Program Office (FNPPO)

Presidential authority to adjudicate disputes in 30 days.

Scoreboard (public, quarterly):

1. Firm MW added by region (gas, nuclear, CCS coal).

2. TWh delivered to AI parks & industrial clusters at or below target $/MWh.

3. Transmission miles energized (5,000 mi/yr. cadence).

4. Interconnection cycle time (request → interconnection agreement and projects cleared)

5. Canada imports (MW available; TWh delivered).

6. Transmission miles energized; transformer lead-times.

7. Workforce: certified craft labor added; nuclear/capture EPC crews mobilized.

Key Focus areas

Transmission & Siting: Activate federal backstop siting for NIETC corridors;

~5,000 miles/year of high-capacity AC/HVDC

Interconnection Reform: Enforce ISO/RTO SLAs (application-to-IA timelines), curtail speculative queueing, prioritize load-following projects tied to DC/industrial anchors. Deterring penalties.

Finance

Accelerated depreciation for firm assets serving AI parks;

Defense Production Act for key supply chains pinch (turbines, transformers, switchgear).

Workforce:

National craft training surge (nuclear welders, electricians, controls techs);

green-card fast lanes for power EPC skills.

Invest ($282B over 5 years)

Regulatory reduction (enablement) - Penalties for regulatory delays: ~$24B

Targeted tax credits (performance-based): ~$175B

Research (applied, build-speed): ~$83B

Reduce regulations, penalties for delays —

~$24B over 5 years

Goal: Cut time to-power by 50%.

1) Facilitate faster timing - Statutory shot-clocks with penalties; Single Docket lanes

NEPA/EIS shot-clock: 12 months for EA; 24 months for EIS on power, pipelines, HVDC, CO₂ pipelines, and nuclear

Single federal lead agency.

Model permits: Publish template plans (EIS + standardized mitigation) for:

· Gas plants/H₂-ready turbines

· CCS retrofits,

· Uprates at existing nuclear sites.

NRC “Single Docket” lane: Unified technical + environmental docket for standardized designs; site-bounded supplements only.

2) Reliability Corridors:

Federal designation of corridors for gas pipelines, HVDC trunks, and CO₂ pipelines into AI/industrial hubs. National Reliability Corridors (NRC): FERC/DOE siting backstop if states stall >12 months.

Three HVDC “spines” + six East/West gateways (interties into AC grids):

· Southwest→Texas→Southeast (solar-heavy),

· Northern Plains/Midwest→Mid-Atlantic/Northeast (wind-heavy),

· Quebec/Great Lakes/East nuclear+hydro → Midwest & PJM/NY/NE (firm imports).

· Target transfer capacity: 60–80 GW aggregate by 2030; 120–150 GW by 2035.

· Build cadence: ~10,000 miles energized by 2030;

~25,000 miles by 2035 (mix of overhead & HVDC-light underground on rail/road corridors).

Interconnection: ISOs/RTOs must meet cycle-time targets or pay Federal penalties

priority lane for projects co-sited with DC and industrial loads. Median permit time (months) by asset class; miles of corridors permitted; interconnection cycle-time. Queue fast lane: Interconnection priority for transfer-enhancing projects; ISO/RTO SLAs with penalties. ROW playbook: Use rail, interstate, and pipeline ROW to cut litigation; pre-negotiated tribal/landowner comp frameworks.

Continental Transmission (CT) Backbone: link Sun-rich solar Southwest, Wind-rich Midwest/Plains, and Hydro/Nuclear East

Move surplus, cheap MWh to the nation’s AI & industrial load pockets

Ai Enabled, on demand at low cost per MWh

3) State and Utility Enablement Fund

· Grants to state PUCs and environmental agencies to clear backlogs.

· Increased Staffing: +1,500 FTE across NRC, FERC, DOE Grid Deployment, PHMSA, EPA UIC

· Federal Energy Litigation Unit to defend approvals.

· Direct grant assistance for utilities/ISOs:

· ISO / Utility investments qualify for accelerated depreciation in transmission, new plants,

wildfire hardening, storm resilience,

interconnections, solar/storage,

financial interest rate costs

· Grants for capacity. Grants for energy/fuel. Grants for transmission/distribution.

Tax credits (time-limited, performance-based) — ~$175B over 5 years

Tightly scoped, step-down, pay for delivered reliability near load.

1) Firm Power Credit (FPC) for near-load gas (H₂-ready) - $40B

Design: Performance PTC paid on delivered MWh during defined peak hours within designated Reliability Corridors;

bonus for black-start capability.

Guardrails: Best-in-class methane intensity; readiness for ≥20% H₂ blend by 2032.

Outcome: 40–60 GW new firm capacity by 2030.

2) Nuclear scale-up & life-extension package - $60B

· Nuclear LTO ITC for uprates/digital controls & life-extension capex at existing plants.

· NOAK production adder for standardized large PWRs/SMRs that meet schedule & cost gates.

· HALEU fuel-cycle incentives (conversion, enrichment, fab) + strategic inventory.

· Federal take-or-pay contracts.

3) Surgical “Clean Coal” via CCS / H2– $35B

CCS performance PTC for ≥90% capture; CO₂ transport & storage ITC in designated hubs;

bonus for tying into industrial CO₂ sources.

Outcome: 8–12 GW of strategic CCS-equipped coal/gas in coal-reliant regions.

4) Wires & equipment - $35B

· HVDC/Transmission ITC with step-down (e.g., 30%→10% by 2032) for NIETC/backbone lines. ($25B)

· Transformer/switchgear manufacturing credit to onshore long-lead equipment. ($10B)

5) Canada imports accelerator (bridging) - $5B

Cross-border HVDC credit for U.S.–Canada interties that deliver firm power into load pockets;

de-risk merchant elements.

Fund research

(construction productivity, nuclear fuels, CCS/H2) — $83B over 5 years

Chase “time-to-megawatt” efficiency and scale

1) Nuclear build system ($30B)

Modular construction methods, standardized EPC “playbooks,” digital QA/QC; component industrialization (valves, pumps, I&C); advanced workforce simulators.

HALEU: enrichment, deconversion, pellet fab; fuel-qualification testing.

2) Gas + H₂ + CCS ($12B)

H₂-capable turbine combustors (NOx control), materials; high-efficiency CC upgrades; CCS solvent/sorbent step-change projects; CO₂ MRV tech.

3) Grid hardware & resilience ($5B)

Fast-manufacturable transformers, power electronics, HVDC converters; cyber-hardening for AI campus co-gen and microgrids.

4) Storage & flexibility enablers ($5B)

Long-duration storage pilots tied to nuclear/gas campuses (for evening peaks), thermal storage for industrial heat.

5) AI-for-grid ops & permitting ($3B)

Dispatch optimization for DC-heavy systems; automated permit drafting & environmental mitigation modeling.

6) Continental Transmission (CT) ($28B)

Unlock ~100–200 TWh/yr. of stranded wind/solar and firm imports, directly serving AI/industrial hubs.

o Power electronics & protection for multi-terminal HVDC

o Dynamic line rating & topology optimization for AC/HVDC meshes;

o AI-assisted dispatch of interregional transfers.

o Advanced Storage (as available)

Total research (5y): $83B

Detail by Energy Type:

Natural Gas (firm backbone; H₂-ready; site near load)

Objective: Add the fastest-to-market capacity adjacent to the biggest AI and industrial nodes.; H₂-ready turbines to future-proof

Fix gas deliverability. Clear critical pipeline corridors

· Appalachia→Mid-Atlantic;

· Gulf→Southwest

· Near to or On-site/behind-the-meter generation for DCs in constrained regions (with grid-service obligations).

2031–2035: “Decarb Options On-Ramp”

CCS-readiness for select baseload CCs near geologic storage; start blending low-carbon H₂ where economic.

Methane control: enforce super-emitter elimination and continuous monitoring to keep gas climate-competitive.

Risks & Mitigations

Pipeline opposition → national security designation for reliability corridors; shared-benefit tariffs; targeted community comp.

Fuel price volatility → long-dated supply hedges; storage expansions.

KPIs (quarterly)

New firm MW energized; pipeline miles added/debottlenecked; $/MWh at DC hubs; methane intensity.

“Clean Coal” - coal marketplaces - selective use,

(carbon sequestration optimized)

Objective: Keep critical coal regions reliable while decarbonizing (scheduled ramp down)—

Targeted CCS (Coal Carbon Sequestration) retrofits where plants are young, and underutilized.

2026–2030: “Selective Retrofit & Reliability Insurance”

Pick best candidates: sub-50th utilization (low to partially utilized plants), with long remaining life,

near CO₂ storage.

Bundle projects with CO₂ pipeline & storage hubs;

standardize capture trains; fixed-price with upside sharing.

Designation of strategic reliability assets with strictest (leadership) emissions caps.

2031–2035: “begin ramp down of lowest performing assets (sun setting)”

CCS ramp down parallels ramp down of overall coal.

KPIs (quarterly)

· TWh optimized; $/ton CO₂; CC rating, strategic reserve hours delivered.

Nuclear: life-extend now; add new Nuclear ASAP- (standardize & replicate)

Objective: Preserve every existing GW, restart what’s restartable, execute repeatable build system (large PWRs + SMR campuses) tied to AI and industrial loads.

2026–2030: “Hold & Restart”

Life-extensions: lock in 20–40 extra operating years for the whole fleet; execute uprates where feasible.

Restarts: bring mothballed units back where economics penciled; pair with 10–20-year baseload offtake from hyperscalers/industrial campuses.

Fuel security: fast-track HALEU and full-cycle domestic fuel (conversion, enrichment, fabrication); strategic stockpiles.

Regulatory sprint: one standardized licensing lane per design; single set of environmental & seismic reference cases;

“digital twin” documentation.

Finance: federal take-or-pay power contracts for first-movers; production credits + loan guarantees;

state CWIP allowances where needed.

2031–2035: “Build Supply Trains”

· Standardize 1–2 large-reactor designs (PWR) and 1–2 SMR/advanced designs.

· Campus model: co-site SMRs with mega-DC parks and industrial clusters (nuke heat + power).

· Workforce surge: nuclear construction corps; craft labor pipelines via community colleges; veteran hiring pathways.

· Repeatable EPC packages, fixed-scope modules, performance bonds.

Delivery Timeline (what happens when)

2026–2027 (Stabilize & Prove Speed)

10–15 GW gas online at AI/industrial nodes; 1–2 nuclear restarts

1,500–2,500 miles transmission energized.

Federal reliability corridors

2028–2030 (Scale to the Stretch)

Additional 20–30 GW gas (H₂-ready);

fleetwide nuclear LTO substantially complete;

4,000–5,000 miles/year transmission cadence.

Near to or Co-sited firm capacity covers the majority of new DC parks – gas, smr, solar/storage

Industrial +25% electricity growth realized.

Portfolio of some co-sited supply at the biggest campuses for reliability + heat reuse, near-load plants for capacity and fast interconnects, and remote bulk supply tied in with HVDC for cost scale.

2031–2035 (Lock-In & Decarbonize)

First standardized new-build reactors online;

SMR campuses at two or more mega-DC/industrial sites;

Gas fleets begin economical H₂/CCS blending.

Long-term trajectory

Nuclear begins supplanting natural gas starting ~2030 and accelerates through 2065.

AI-optimized grids begin pilots before 2030 and scale to become the operating fabric of the U.S. power system by 2065.

“AI-optimized grids” (pilots in 2030 → operating fabric by 2065)

Operating concept

Treat data centers, advanced loads, and storage as grid assets—not just customers.

Use AI control to shape demand, schedule flexible compute, and co-optimize power generation, storage,

and HVDC transfers in real time.

2026–2030: Readiness & first pilots

Telemetry mandate: 1-second telemetry and dispatch rights for ≥25% of DC load in pilot ISOs; standard APIs for load-flex bids.

Compute deferral products: Markets create “Flex-Compute” and “Batch Windows” (e.g., move 10–30% of inference/training within 2–8 hr) with settlement like ancillary services.

Grid-forming inverters spec for all ≥100 MW battery fleets; black-start from batteries at two nuclear campuses.

Digital twins for 3 pilot regions (one per HVDC spine): real-time topology + restoration planning.

2031–2035:

25–40% of DC load becomes dispatch-aligned; AI micro-schedulers in DC campuses coordinate with ISO day-ahead & real-time.

Multi-terminal HVDC control: automated congestion relief and AI-directed power routing across spines.

ELCC accreditation rewards duration + grid-forming capabilities;

Solar+storage established for standard evening blocks.

Distribution automation roll-out near DCs/industry (feeder sectionalizers, adaptive protection).

2036–2045:

System-wide AI dispatch co-optimizes nuclear baseload, VRE+storage, HVDC transfers, and flex loads;

constraint violations drop >70%.

Autonomous restoration: sub-minute islanding of DC campuses + adjacent industry; self-healing feeders; black-start sequences rehearsed monthly.

2046–2065: Self-tuning grid

Predictive maintenance with fleet-wide models; outage probabilities feed unit commitments day-ahead.

DCs dynamically shift training jobs across regions

AI-supervised mesh.

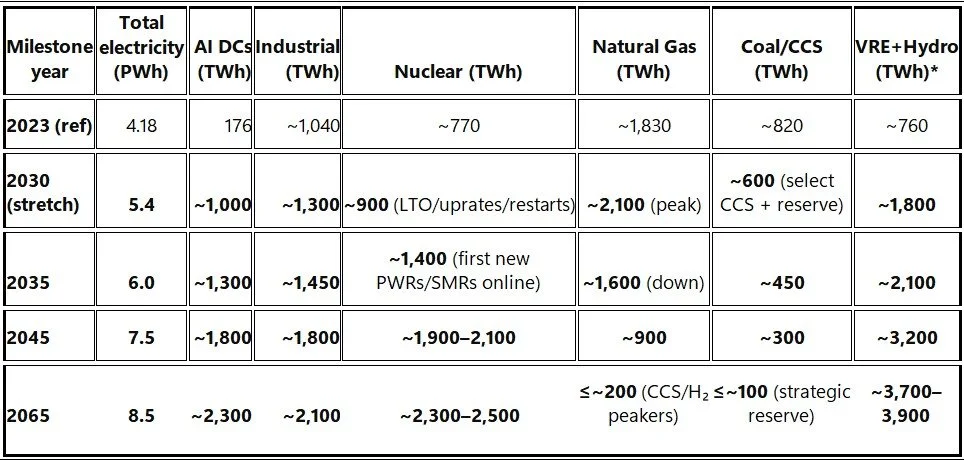

Multi-decade Electrical Production Planning (EPP):

*VRE+Hydro = wind + solar (utility + distributed) + storage-firmed deliveries + hydro.

gas peaks 2028–2032, nuclear replaces gas in delivered TWh

Begin planned gas roll-down: retire least-efficient units, convert part of the fleet to CCS/H₂-ready. Gas drops to ~900 TWh by 2045, increasingly peaking/backup; nuclear rises to ~2.0 PWh.

This is the sister plan to achieve climate leadership

that China is now working toward,

but in the U.S., using “cleaner” natural gas

to make the energy transition.

Technical Enablers (Priorities):

Transformers: “Control the bottleneck”

Over a 40-year timeframe, Large power transformers (LPTs) are essential grid component. Currently 18–30 month bottle neck with tight, China dominated global capacity.

Strategic Transformer Reserve: pre-buy 200–300 LPTs and 1,000+ medium transformers, staged at regional depots; rotate into service before warranty expiry. blanket multi-year orders; require dual-tooling at vendors; U.S. testing labs open 24/7

Domestic factory sprint: fast-track 2–3 new LPT plants (Hitachi Energy, Siemens Energy, GE-Prolec. Federal capital grants”

Standardized specs: narrow to3 families (e.g., 345/230/138 kV) - factories hit repetition learning curves; make them modular for rapid site fit. Rapid-restore kits: mobile transformers, spare converter valves, prefab substation skids; pre-approved transport routes & bridge ratings.

Batteries: Leapfrog Lithium Ion –

Long Duration Storage

Over a 40-year timeframe, sustained bets on high-risk, high-reward technologies—allow China to own legacy lithium-ion while US seeks successor generations of battery technology

Invest in domestic mining, refining, and processing of lithium, nickel, cobalt, rare earths, and alternative materials

(e.g. sodium, magnesium).

Double down on R&D → De-risk scale-up. Fund mid-stage demonstration plants (not just lab-scale) for novel chemistries (solid-state, lithium-metal, sodium-ion, hybrid). Beat China on innovation in advanced cathode/anode, solid electrolytes, silicon-metal, etc.

Solve regulatory, cost, or demand uncertainties. Turn innovation into gigawatt-level manufacturing through government action.

Result: U.S. becomes a net exporter of advanced battery systems, capturing supply chain control. Fully integrate into grid supporting renewables (wind, solar), long-duration storage, and AI datacenters.

HVDC Spines (Continental Transmission)

Three spines + six gateways; 60–80 GW transfer by 2030, 120–150 GW by 2035.

Feed nuclear campuses and AI parks, letting nuclear displace gas in select regions without local scarcity.

Parallel segmenting, standardized converter stations, use rail/highway pipelines, performance-bonded energy delivery. Coordinated ISOs working together.

20-Year Cost

(Score with Congressional Budget Office)

Projected 20-yr:Federal Budget: ~$725B

1st Tranche: $282B over 5 years 2026-2030; $56.4B per year

Fund a 70% with direct federal appropriations

“The Manhattan Project for Energy”

Fed Share:

1st Tranche (2026-2030) $197B ($39.5B/yr)

Remaining 15 yrs (2031-2045) $525B ($35B/yr)

$725B federal over 20 years – Only $36 Billion /yr -

“good investment” for Americans.

Power for AI Leadership National Initiative (America’s “moonshot” for Energy)

$725B over 20 years ≈ $36.3B/yr. That’s ~0.13% of U.S. GDP. That’s≈ $279 per household per year – less than the cable bill for power for our Ai.). Modest cost to deliver AI competitiveness, and USA re-industrialization and jobs.

Why it’s “cheap” versus other trillion-dollar ideas:

It crowds in private/state investment (skin in the game). 70/30 structure turns $725B federal into $1.1T (states + private) – we are all in this together. A national moonshot in energy.

It pays back in the tax base. Cheaper, reliable power attracts AI campuses and factories for sustained payroll, property, and corporate taxes.

When it wouldn’t be cheap – Delays cost money!:

If we lose schedule discipline (nuclear delays, HVDC litigated to death), we lose momentum and efficiency.

If gas creeps into baseload (no run-hour caps or methane kill-switch), climate concerns increase. We need to have strong penalties to deter this capitalism blind spot

If we fail to standardize (every reactor/transformer/solar-hybrid), we forfeit efficiency.

Standardization above innovation for cost efficiency.How to keep it cheap:

Milestone payments only with clawbacks. (Pay from performance and deliverables only)

Standardize (2 PWR designs + 1–2 SMR, 2–3 transformer families, standardized/approved gas configurations).

Scoreboard (firm MW, dispatchable MWh 5–10pm, HVDC miles, methane intensity, etc).

Nuclear R&D ($30B) focused on “build-system speed” (modules, QA/QC, HALEU),

not science.Penalize delays / Gas Creep (Penalties for Milestone delays or missing declining gas targets).

Conclusion:

Now is the time! – Ai is here…

and National Security is at stake.

Mission: Replace coal, cap and shrink gas energy, and anchor the grid with modern nuclear—

while moving abundant solar and wind energy across the country.

Investment:

Federal spending of $725 billion over twenty years— $36 Billion per year.

70/30 Split: Federal funds 70%, states bring 30%. Bonuses for fast states (80/20; 90/10 splits for interstate backbone project completion on time – no delays)

“Green Dividends”:

Methane kill-switch: super-emitter detection + immediate curtail orders; leak-rate caps as

precondition for gas capacity payments.

Conservation banking: every HVDC/gas/nuclear corridor contributes to a “habitat bank” that funds wildlife crossings, wetlands, and landscape-scale conservation.

Coal / CCS sunset targets - CCS limited: CCS grid-critical ≥90% capture. Sunsetting CCS starts 2030.

Transmission in Wildlife Corridors- undergrounding in sensitive segments / “pre-approved” wildlife corridors.

Air & water standards with penalties

“Community Benefit Agreements (CBAs) for host counties”:

Signed revenue sharing, job quotas, training funds, property-tax floors, and environmental mitigation dollars agreements.

Federal Milestone payments, not promises

Headlines

“Gas down each year, nuclear up”

“Build fast—we are all in this together – The National Moonshot for Energy.”

“Standardize, replicate, deliver.”

“Quarterly scoreboards, not press releases.”

Main points

Power = national security.

Outcomes, not ideology: Retire coal, cap and shrink gas yearly, stand up nuclear-as our anchored firm production and move cheap solar/wind over “continental transmission”.

Why now: Data centers + factories will add demand this decade.

Ai is here. Delay = higher bills, lost jobs, and ceding leadership in Ai.

Affordability: Federal share ≈ $725B over 20 years (~0.13% of GDP/yr).

Attracts state/private dollars; pays back in jobs and tax base.

Build a system, not just one-offs: Two standardized reactor designs; cookie-cutter gas bridge blocks with run-hour caps; 2–3 transformer families; repeatable HVDC gateways.

Rules with teeth: Methane kill-switch; declining gas MWh caps; clocked permits; milestone-based payments with clawbacks.

70/30 Compact: Federal funds 70%, states bring 30%.

Bonuses for fast states (80/20; 90/10 for interstate backbones ahead of schedule).

Environmental integrity: Impacts are real. We plan them: coal sunset, strict methane, habitat banking, Environmental Justice safeguards, consent-based nuclear waste sites (we’re all in this together).

Workforce first: 25–30k skilled trades for nuclear trains; transformer plants onshore;

apprenticeship pipelines; veteran hiring.

Scoreboard, quarterly: Firm MW online, evening dispatchable MWh (5–10pm), HVDC miles,

queue cycle-time, methane intensity, community benefits.

Q&A (tough questions → concise answers)

Q1: Isn’t this just a fossil fuel expansion in disguise?

A: No. Coal sunsets. Gas is a capped bridge with run-hour limits and a methane kill-switch. The firm anchor is nuclear,

and the growth is solar/wind + storage.

Q2: Nuclear is too slow/expensive—why bet on it?

A: We standardize two designs and build in trains. That’s how costs fall and schedules compress—and why gas MWh decline each year as nuclear comes online. Replicate, don’t reinvent.

Q3: What about nuclear waste?

A: Dry-cask storage is safe and proven. We’ll run consent-based storage pilots and modernize logistics. Meanwhile, waste volumes are tiny relative to the energy produced. Manageable, transparent, consent-based.

Q4: Won’t rates go up?

A: The cheapest power is the power you can actually deliver. This plan cuts congestion, adds evening supply, and shares costs nationally. Our target is lower, steadier $/MWh at AI hubs and factories, not higher bills.

Q5: Why not 100% renewables now and skip gas and nuclear?

A: We need firm power to back evenings, heat waves, and storms. Batteries help, but not alone. Nuclear delivers firm zero-carbon; gas covers peaks with caps as we scale nuclear. Reliability, emissions down fastest.

Q6: Environmental justice—what changes on the ground?

A: Host communities get CBAs: jobs, training, tax floors, local air and water monitoring, and islandable microgrids. Projects don’t move without signed benefits. Nothing about you without you.

Q7: Permitting always takes years—what’s new?

A: Programmatic EIS, 12–24-month statutory shot-clocks, one lead agency, and milestone payments. If a state stalls, funds reallocate. Time limits with teeth.

Q8: Is $725B federal enough?

A: Yes—because the 70/30 compact crowds in state and private capital, and we pay by milestones. The cost is small relative to the upside in jobs, tax base, and security. Leverage, not blank checks.

Q9: What if AI fizzles?

A: It won’t but this same backbone powers semiconductors, electrified industry, and resilience. Valuable infrastructure regardless of what happens with Ai. No-regrets.

Q10: Cyber and safety risks from AI-run grids?

A: Human-in-the-loop, independent red-teams, segmented control planes, and quarterly drills. AI optimizes; operators decide. Secure by design and better than other areas we secure.

Q11: Canada relations are rocky—why count on imports?

A: Canada is our partner. 50 TWh net electricity is possible and we can get a deal done. These net imports are an accelerator, and good for both sides. Interconnected power is strength.

Q12: How do you prevent “gas creep” into baseload?

A: Publish declining gas-MWh caps, enforce run-hour limits, and tie capacity payments to compliance. Nuclear replaces gas year by year. Penalties for missing targets.